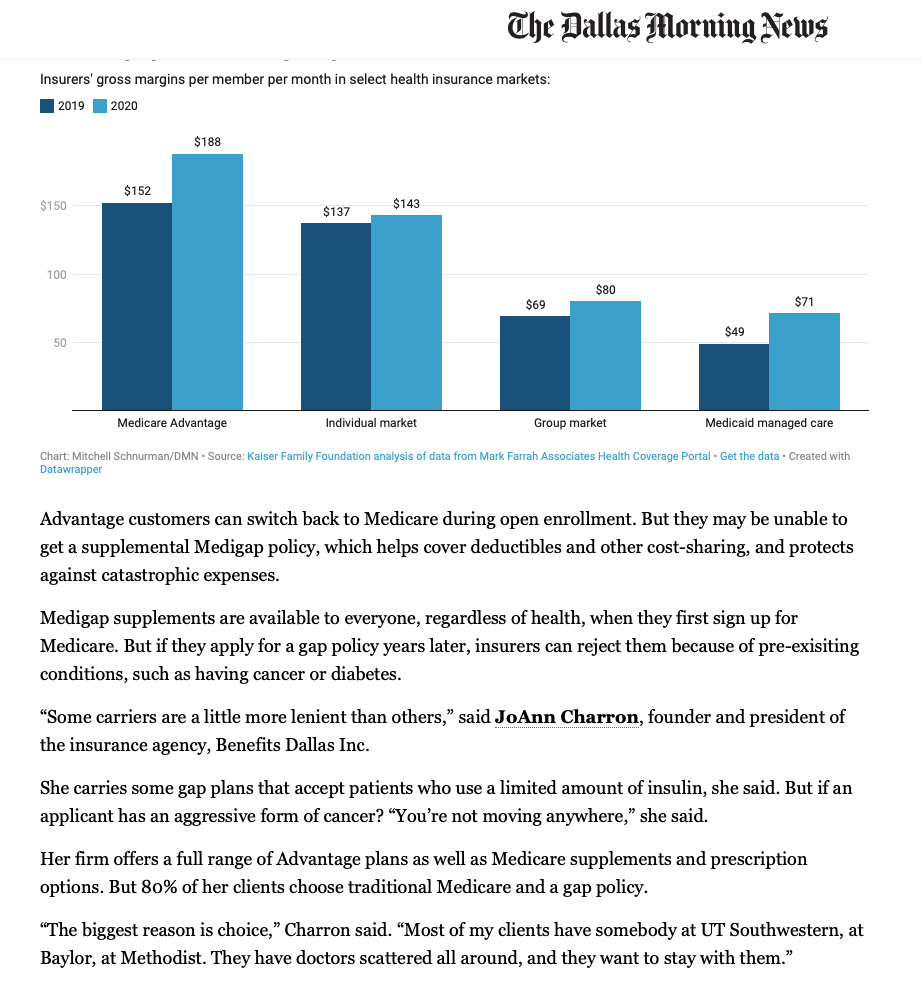

There’s a tradeoff in having a narrow network, especially if you get sick and want treatment outside the plan.

Excerpt as published in the Dallas Morning News on November 9th, 2021 in the article by Mitchell Schnurman

Advantage customers can switch back to Medicare during open enrollment. But they may be unable to get a supplemental Medigap policy, which helps cover deductibles and other cost-sharing and protects against catastrophic expenses.

Medigap supplements are available to everyone, regardless of health, when they first sign up for Medicare. But if they apply for a gap policy years later, insurers can reject them because of pre-existing conditions, such as having cancer or diabetes.

"Some carriers are a little more lenient than others," said JoAnn Charron, founder and president of Benefits Dallas Inc's insurance agency.

She carries some gap plans that accept patients who use a limited amount of insulin, she said. But if an applicant has an aggressive form of cancer? "You're not moving anywhere," she said.

Her firm offers a full range of Advantage plans as well as Medicare supplements and prescription options. But 80% of her clients choose traditional Medicare and a gap policy.

"The biggest reason is choice," Charron said. "Most of my clients have somebody at UT Southwestern, at Baylor, at Methodist. They have doctors scattered all around, and they want to stay with them."

Share this story